taxes on lottery winnings calculator canada|Are There Taxes On Lottery Winnings In Canada? : Bacolod All forms of lottery winnings are never taxed in Canada, whether you win only a portion or the entirety of the prize pool. Lottery winnings, government monetary benefits, and amounts received from life insurance . “MBDD-2112 CherryBlossom/宮下玲奈”的详细资料与讨论。与其他人讨论并评论这个影片或是寻找其他相关影片。

taxes on lottery winnings calculator canada,Winnings from a Canadian lottery such as Lotto Max or 649 are considered to be windfalls, and windfalls are not subject to tax. Even winnings from a sweepstake or lottery sponsored by a charitable organization are generally tax-free.

What is a windfall? According to the CRA, windfalls can encompass various types .Are There Taxes On Lottery Winnings In Canada? All forms of lottery winnings are never taxed in Canada, whether you win only a portion or the entirety of the prize pool. Lottery winnings, government monetary benefits, and amounts received from life insurance . Yes, lottery winnings in Canada are generally subject to taxation. When an individual wins a lottery prize, whether it’s a lump-sum payment or annuity payments, the prize is considered taxable income by the Canada Revenue Agency (CRA). How much tax do you pay on lottery winnings in Canada? Lottery winnings are considered “financial windfalls.” In other words, an unexpected surplus of cash. Licensed insolvency trustees at David .

taxes on lottery winnings calculator canada Are There Taxes On Lottery Winnings In Canada? Lottery winnings in Canada are subject to taxation by the Canada Revenue Agency (CRA). The tax treatment of lottery winnings depends on several factors, including the type and amount of the prize, the individual’s overall income, and the province or territory in which the winner resides. What is a windfall? According to the CRA, windfalls can encompass various types of unexpected payments. Common examples include: Lottery winnings. Inheritances. Personal gifts. Additionally, less common forms include: Veteran’s Affairs disability or death benefits related to war veterans (excluding federal disability programs)taxes on lottery winnings calculator canada Lottery winnings in Canada are also subject to federal and provincial taxes. The amount of tax paid on lottery winnings depends on the size of the winnings, the province of residence, and other factors. Winners should seek advice from a tax professional to determine the best course of action.In Canada, lottery winnings are not considered regular income, so they are not taxed like your job’s salary would be. Instead, they're seen as a windfall or a one-time gain. That's good news for winners, as they get to pocket the full amount they win. Example: Imagine you win $1 million in a Canadian lottery. Unlike some countries where you . Under Canada’s Income Tax Act, money earned from a lottery is considered a financial windfall or, to put it another way, an unexpected surplus of cash. And since financial windfalls aren’t subject to income tax, you’re not required to report lottery winnings on your tax return.

Lottery winnings are not taxable in Canada. If you win money through a lottery, like Lotto 6/49 or Lotto Max, it’s all yours to keep, whether it’s $100 or $10 million. Under Canada’s Income Tax Act, money earned from a lottery is considered a financial windfall or, to put it another way, an unexpected surplus of cash.

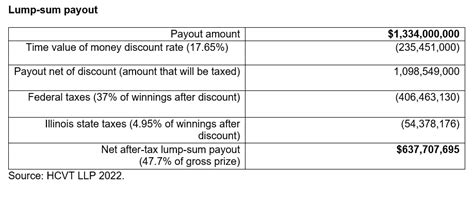

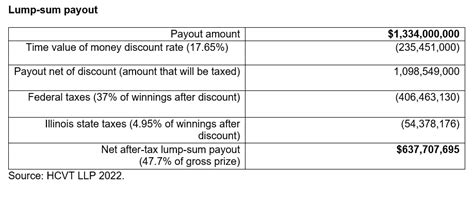

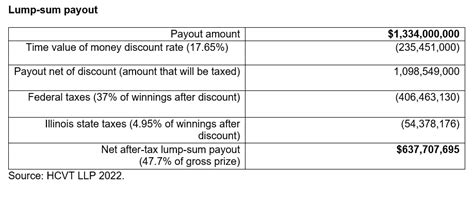

If you have a different tax filing status, check out our full list of tax brackets. $0 to $11,600. 10% of taxable income. $11,601 to $47,150. $1,160 plus 12% of the amount over $11,600. $47,151 to . No, lottery winnings aren’t taxed in Canada. Whether you earn just a couple of bucks or millions of dollars from a lottery pot, your earnings don’t need to be reported to the Canada Revenue Agency . However, the CRA clarifies that although every cent you earn from the lottery is tax-free, the income your earnings generate when . 13.8% taxes on all winnings: Canada: Tax-free: Chile: 17% tax on all winnings: Colombia: Tax-free up to COP70,000; 20% tax above COP70,000: France: Tax-free: Germany: Tax-free: . How do you calculate taxes on $5,000 lottery winnings? The taxes depend on your country of residence. For example, a player in the United States, .Lottery Tax, Tax on Lottery Winnings, US Tax on Lottery Prizes, State Tax, Fedral Tax Close Select Lotteries Atlantic Canada British Columbia Ontario Quebec Western Canada USA Canada Europe South America Africa Asia Australia

Uncover the tax implications of lottery winnings in Canada. Our guide breaks down the rules, exemptions, and considerations for managing taxes on your lottery prize. Stay informed to navigate tax season confidently . The exact percentage can vary, but it usually ranges from 25% to 37%. If you are interested in European lotteries, you may be happy to know that most of them are virtually tax-free. For example, the United Kingdom, Italy, France, and Germany do not charge taxes. Spain and Portugal, however, charge a 20% tax on lottery winnings.

Here's how you'd calculate your after-tax amount: Tax-free amount: CNY 10,000 (because it's below the threshold) Taxable amount: CNY 90,000 (the rest of your winnings) . In Canada, lottery winnings are not considered regular income, so they are not taxed like your job’s salary would be. Instead, they're seen as a windfall or a one-time gain

taxes on lottery winnings calculator canada|Are There Taxes On Lottery Winnings In Canada?

PH0 · Tax Implications of Canadian Windfalls

PH1 · Is Lottery Winnings Taxable In Canada?

PH2 · How Lottery Winnings Are Taxed

PH3 · How Long Does It Take To Receive Lottery Winnings In Canada?

PH4 · Do You Pay Tax on Lottery Winnings in Canada? – PiggyBank

PH5 · Are my prize or lottery winnings taxed?

PH6 · Are There Taxes On Lottery Winnings In Canada?

PH7 · Are Lottery Winnings Taxed in Canada? What You Need to Know

PH8 · Amounts that are not reported or taxed

PH9 · Advisorsavvy